Contents

- 1 Evaluating the Scope of Coverage and Policy Exclusions Demands Careful Consideration

- 2 Determining the Appropriate Coverage Limits and Deductibles Requires Careful Assessment

- 3 Navigating the Claims Process and Understanding Policy Obligations is Paramount: Professional Liability Insurance

- 4 Exploring the Role of Risk Management Practices in Reducing Liability Exposure is a Smart Move

- 5 Detailed FAQs

Evaluating the Scope of Coverage and Policy Exclusions Demands Careful Consideration

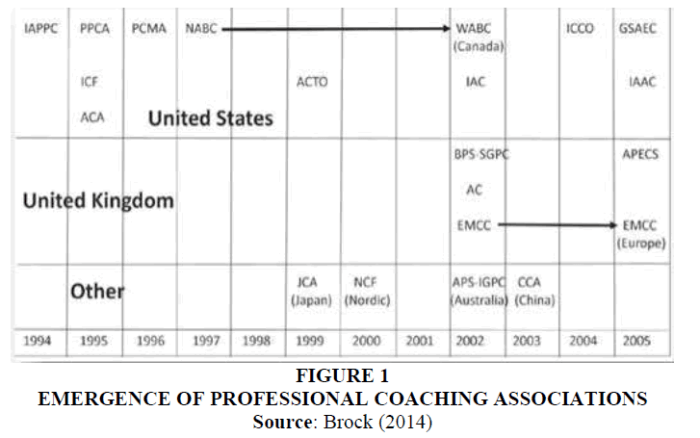

Source: abacademies.org

Professional liability insurance, also known as errors and omissions (E&O) insurance, is crucial for protecting professionals from financial losses resulting from claims of negligence, errors, or omissions in their professional services. Understanding the nuances of a policy, particularly its scope of coverage and exclusions, is essential for ensuring adequate protection. This involves a careful examination of the policy document to grasp what is covered and, perhaps more importantly, what is not.

Understanding the Standard Components of a Professional Liability Policy

A standard professional liability policy comprises several key components, each playing a vital role in defining the scope of coverage. These components work together to provide a comprehensive framework for protection.

- Declarations Page: This section identifies the insured, the policy period, the premium, the coverage limits, and the deductible. It’s essentially the “who, what, when, and how much” of the policy. The declarations page provides a snapshot of the policy’s key information, serving as a quick reference guide.

- Insuring Agreements: This section Artikels the specific types of claims the policy covers. It defines the circumstances under which the insurer will provide financial protection, typically including coverage for claims arising from negligent acts, errors, or omissions in the provision of professional services. The insuring agreements specify the scope of the coverage.

- Exclusions: This section lists specific situations or events that are

-not* covered by the policy. Exclusions are a critical part of the policy, as they define the limits of the insurer’s liability. Understanding these exclusions is vital to assessing the policy’s overall protection. - Conditions: This section Artikels the responsibilities of both the insured and the insurer. It specifies the obligations of the insured, such as reporting claims promptly and cooperating with the insurer’s investigation. It also details the insurer’s rights and obligations, such as the right to defend the insured against a claim.

These components interrelate to provide comprehensive protection. The declarations page sets the foundation, the insuring agreements define the scope of coverage, exclusions limit that coverage, and conditions govern the policy’s operation. This interplay ensures that both the insured and the insurer understand their rights and obligations.

Common Exclusions and Their Implications

Professional liability policies commonly include specific exclusions that limit coverage. These exclusions are designed to protect the insurer from certain types of risks and behaviors. Understanding these exclusions is critical for policyholders to assess the potential gaps in their coverage.

- Intentional Acts: This exclusion typically eliminates coverage for damages arising from intentional wrongdoing, such as fraud, misrepresentation, or deliberate acts of harm. If a professional intentionally causes harm to a client, the policy generally won’t cover the resulting damages.

- Fraud: Similar to intentional acts, fraud is often explicitly excluded. This exclusion protects the insurer from liability for claims arising from fraudulent activities, such as knowingly providing false information or engaging in deceptive practices.

- Prior Acts: Many policies exclude claims arising from acts or omissions that occurred

-before* the policy’s effective date. This is a common exclusion designed to prevent coverage for pre-existing liabilities. This means the policy won’t cover claims related to work completed before the policy was in force.

These exclusions can significantly impact policyholders. For example:

- Scenario 1: An accountant knowingly falsifies financial statements for a client, and the client’s investors subsequently suffer losses. Because of the fraud exclusion, the accountant’s professional liability policy likely would

-not* cover the resulting claims. - Scenario 2: A lawyer intentionally withholds crucial evidence in a client’s case, leading to the client losing the case and suffering financial harm. The intentional acts exclusion would likely prevent coverage under the lawyer’s professional liability policy.

- Scenario 3: A consultant provides negligent advice to a client in 2022, but the client doesn’t file a claim until 2024, after the consultant purchased a new professional liability policy in 2023. The prior acts exclusion in the 2023 policy would likely mean the claim is not covered.

Comparing Coverage Across Different Professional Liability Policies

The following table provides a comparison of key features and benefits across different professional liability insurance providers. This table helps to illustrate the differences in coverage options available in the market.

| Feature | Provider A | Provider B | Provider C |

|---|---|---|---|

| Coverage Limit | $1 Million per claim / $2 Million aggregate | $2 Million per claim / $4 Million aggregate | $1 Million per claim / $1 Million aggregate |

| Defense Costs | Included within the policy limits | Included within the policy limits | Outside the policy limits |

| Retroactive Date | Same as policy inception | 5 years prior to policy inception | No retroactive coverage |

| Exclusions | Standard exclusions, no specific industry exclusions | Standard exclusions, includes exclusion for intellectual property infringement | Standard exclusions, includes exclusion for cyber liability |

- Coverage Limit: This indicates the maximum amount the insurer will pay for a single claim and the total amount the insurer will pay during the policy period. Higher limits provide greater financial protection.

- Defense Costs: This indicates whether the cost of defending a claim is included within the policy’s coverage limits or is in addition to the limits. Policies that cover defense costs outside the limits offer better protection, as they don’t erode the coverage available to pay for a settlement or judgment.

- Retroactive Date: This specifies the date from which the policy will cover claims. A longer retroactive date provides broader coverage for prior acts.

- Exclusions: This highlights specific situations or events that are not covered. Understanding the exclusions is critical for assessing the policy’s limitations.

Determining the Appropriate Coverage Limits and Deductibles Requires Careful Assessment

Professional liability insurance, also known as errors and omissions (E&O) insurance, provides crucial protection for professionals against claims alleging negligence, errors, or omissions in their services. However, the effectiveness of this insurance hinges on selecting the right coverage limits and deductibles. This requires a thorough understanding of the risks associated with the professional’s practice and a careful balancing of cost and protection.

This section delves into the factors influencing these critical decisions.

Determining Coverage Limits

Choosing the appropriate coverage limits is a critical aspect of professional liability insurance. These limits represent the maximum amount the insurance company will pay for a covered claim. Professionals must carefully consider several factors to determine the level of coverage that adequately protects their financial interests and reputation. The aim is to strike a balance: securing sufficient protection without overpaying for coverage that exceeds their needs.The nature of the professional’s work is a primary determinant.

Professionals in high-risk fields, such as medicine, law, or engineering, typically require higher coverage limits due to the potential severity of claims. For example, a medical malpractice claim could involve substantial damages for medical expenses, lost wages, and pain and suffering. Conversely, a consultant providing relatively low-risk services might require lower coverage.The potential financial impact of claims is another crucial consideration.

Professionals should assess the potential financial exposure they face, including the cost of defending against a claim, the potential for settlement or judgment, and the potential for reputational damage. Consider a scenario where a software developer’s code causes a major data breach at a client’s company. The client could potentially sue for the costs of recovering lost data, regulatory fines, and lost business income.

The developer would need coverage limits high enough to address these potential costs.Industry standards also play a significant role. Certain industries or professional organizations may have recommended or required coverage limits. Adhering to these standards can help ensure that a professional is adequately protected and meets the expectations of clients and peers. In the legal profession, for instance, many state bar associations recommend minimum E&O coverage levels.Finally, a professional’s financial resources should be considered.

Even with adequate insurance, the professional may be responsible for amounts exceeding the coverage limits. Professionals with significant personal assets should consider higher coverage limits to protect those assets from potential claims. Conversely, a professional with limited assets may be comfortable with lower limits, understanding that their personal financial risk is relatively lower.

Advantages and Disadvantages of Deductible Options

Deductibles are the amounts a policyholder must pay out-of-pocket before the insurance coverage kicks in. Choosing the right deductible level is a key decision, influencing both premium costs and the financial risk borne by the policyholder. The choice involves weighing the benefits of lower premiums against the potential financial burden of a higher deductible in the event of a claim.Lower deductibles result in higher premium costs.

This is because the insurance company assumes more financial risk. However, lower deductibles can be advantageous because they reduce the immediate financial burden on the policyholder when a claim is made. This is particularly beneficial for professionals who may not have readily available funds to cover a large deductible.Higher deductibles, conversely, result in lower premium costs. This is because the policyholder assumes more financial risk.

The advantage of a higher deductible is the reduced cost of insurance, which can be significant, especially for professionals who believe their risk of claims is relatively low. The disadvantage is that the policyholder must bear a larger portion of the financial burden if a claim arises. This can be problematic if the professional is not financially prepared to cover the deductible.For example, a lawyer might choose a $5,000 deductible to save on annual premiums.

If a claim is made and settled for $50,000, the lawyer would pay the $5,000 deductible, and the insurance company would cover the remaining $45,000. However, if the lawyer chose a $25,000 deductible, the annual premium would be significantly lower, but the lawyer would be responsible for a much larger portion of the settlement in the event of a claim.

Methods for Assessing Risk Exposure, Professional liability insurance

To determine the optimal coverage limits and deductible levels, professionals can employ several methods to assess their risk exposure.

- Analyze Past Claims Data: Reviewing past claims data, if available, can provide valuable insights into the types of claims that have been filed against the professional or similar professionals in the same field. This analysis helps identify potential areas of vulnerability and estimate the potential severity of future claims.

- Conduct a Risk Assessment: A formal risk assessment involves identifying potential risks associated with the professional’s practice, evaluating the likelihood of those risks occurring, and estimating the potential financial impact. This process helps to prioritize risks and determine the appropriate level of coverage needed. For instance, a risk assessment for a financial advisor might include analyzing the risk of providing incorrect investment advice, which could result in significant financial losses for clients.

- Consult with an Insurance Broker: A knowledgeable insurance broker can provide expert advice on coverage limits and deductible options based on the professional’s specific circumstances and risk profile. Brokers can also compare quotes from multiple insurance providers to ensure the best value.

- Review Contractual Obligations: Reviewing contracts with clients can help identify potential liabilities and coverage requirements. Some contracts may require specific levels of professional liability insurance coverage.

- Consider Industry Benchmarks: Researching industry standards and recommendations for coverage limits can provide a useful benchmark. Professional associations and industry publications often offer guidance on appropriate coverage levels.

Source: publicdomainpictures.net

Professional liability insurance, also known as errors and omissions (E&O) insurance, is a critical safeguard for professionals. However, its value is realized only when a claim arises. Understanding the claims process and fulfilling policy obligations is essential for ensuring coverage and protecting your business. This section Artikels the crucial steps involved in navigating the claims process, emphasizing the importance of timely reporting and policyholder responsibilities.

The Step-by-Step Process of Filing a Claim

Filing a claim under a professional liability insurance policy involves a structured process designed to assess the validity of the claim and determine the extent of coverage. Understanding each step and adhering to policy requirements is crucial for a successful outcome.The process typically unfolds as follows:

1. Notification of a Potential Claim

The policyholder becomes aware of a situation that could potentially lead to a claim. This might include a client’s dissatisfaction with services, a formal complaint, or even a demand letter.

2. Initial Assessment and Documentation

The policyholder must carefully assess the situation, gathering all relevant documentation. This includes contracts, correspondence with the client, project files, and any internal records related to the service in question. This initial phase is about building a comprehensive understanding of the situation.

3. Reporting the Claim to the Insurer

Professional liability insurance protects businesses from claims of negligence or errors in their services. While understanding tech advancements is crucial for modern professionals, such as the upcoming battle between the iPhone 17 Air and iPhone 16 Plus, as detailed in ” iPhone 17 Air vs iPhone 16 Plus: 7 Major Differences Revealed ,” it’s equally vital to mitigate financial risks.

Therefore, professional liability insurance provides a safety net for potential legal battles.

The policyholder must promptly notify the insurance company about the potential claim. This is a critical step, often governed by strict timeframes Artikeld in the policy. Delaying notification can have significant consequences.

4. Claim Submission and Documentation

The policyholder submits a formal claim to the insurer, typically using a claim form provided by the insurer. This form requires detailed information about the claim, including the nature of the alleged error or omission, the services provided, the damages claimed, and the involved parties. Supporting documentation, such as contracts, correspondence, and project files, must be submitted along with the claim form.

5. Insurer Investigation

Upon receiving the claim, the insurer initiates an investigation. This investigation might involve:

Reviewing the submitted documentation.

Contacting the policyholder for clarification or additional information.

Interviewing the policyholder and potentially other relevant parties, such as the client.

Hiring experts to assess the claim’s validity and the extent of damages.

6. Coverage Determination

Based on the investigation, the insurer determines whether the claim is covered under the policy. This involves evaluating the policy language, the facts of the case, and any applicable exclusions. The insurer will then issue a coverage decision, which may include accepting the claim, denying the claim, or requesting further information.

Professional liability insurance safeguards businesses from financial repercussions stemming from errors or omissions. Just as the tech world anticipates the revolutionary speed enhancements of the iPhone 17, as detailed in ” iPhone 17 Wi-Fi 7 Speed Boost: 7 Reasons It’s a Total Game-Changer ,” businesses need to be prepared for potential pitfalls. Comprehensive professional liability coverage remains crucial to protect against unforeseen circumstances and associated legal costs, ensuring operational stability.

7. Defense and Settlement

If the claim is covered, the insurer will typically provide a legal defense for the policyholder. This might involve hiring an attorney, paying for legal fees, and managing the legal proceedings. The insurer may also attempt to settle the claim with the claimant, negotiating a settlement amount within the policy limits.

8. Payment of Claim

If the claim is covered and a settlement is reached, the insurer will pay the settlement amount, up to the policy limits. The policyholder is typically responsible for paying the deductible, if applicable.

9. Claim Resolution and Policy Impact

The claim is considered resolved once the settlement is finalized or a judgment is rendered. The claim will be recorded on the policyholder’s claims history, which may impact future premiums and policy terms. The resolution may also involve lessons learned for the policyholder to prevent similar claims in the future.

Importance of Timely Reporting of Potential Claims

Timely reporting of potential claims is a cornerstone of professional liability insurance. Delaying notification can jeopardize coverage and leave the policyholder vulnerable. Insurance policies contain specific provisions regarding the timeframe within which a claim or a potential claim must be reported. These provisions are crucial.Consequences of late reporting include:* Denial of Coverage: The insurer may deny coverage if the claim is reported outside the stipulated timeframe.

This is because late reporting can hinder the insurer’s ability to investigate the claim, gather evidence, and mitigate potential damages.

Loss of Defense

The insurer may refuse to provide a legal defense if the claim is reported late. This leaves the policyholder responsible for all legal costs, including attorney’s fees, court costs, and potential settlements or judgments.

Breach of Contract

Late reporting can be considered a breach of the insurance contract, potentially leading to the cancellation of the policy or the denial of future claims.

Professional liability insurance protects businesses from financial losses due to negligence claims. Considering the rapid technological advancements, much like the compelling features highlighted in the iPhone 17 vs iPhone 16 Comparison: 7 Major Upgrades That Make It Worth It , professionals must constantly adapt. This adaptability underscores the ongoing need for robust professional liability coverage to navigate evolving risks and maintain financial stability.

Difficulty in Investigation

Delaying reporting can make it difficult for the insurer to gather evidence, interview witnesses, and assess the validity of the claim. Memories fade, documents get lost, and the ability to build a strong defense is diminished.To illustrate the importance, consider a scenario: A consultant is aware of a client’s dissatisfaction with a project, but delays notifying their insurer for several months.

By the time the claim is reported, crucial evidence is missing, and the insurer’s ability to investigate and potentially mitigate damages is severely compromised. The insurer may then deny coverage based on the late reporting, leaving the consultant responsible for the client’s losses.

Actions a Policyholder Should Take Upon Receiving a Claim or Notice of a Potential Claim

When a policyholder receives a claim or a notice of a potential claim, a swift and decisive response is critical. Following a structured approach can help protect the policyholder’s interests and maximize the chances of a favorable outcome.Here’s a step-by-step guide:* Step 1: Immediate Assessment: Upon receiving a claim or a notice, the policyholder must immediately assess the situation. This involves understanding the nature of the claim, the potential damages, and the parties involved.

Gather all relevant documents and information.* Step 2: Review the Policy: Carefully review the professional liability insurance policy to understand the coverage terms, exclusions, and reporting requirements. Pay close attention to the definition of a “claim” and the deadlines for reporting.* Step 3: Notify the Insurer Promptly: Notify the insurance company immediately, following the reporting procedures Artikeld in the policy. Most policies require written notification, which should include all relevant details of the claim.

Keep a copy of the notification and any supporting documentation.* Step 4: Cooperate with the Insurer: Cooperate fully with the insurer’s investigation. This includes providing all requested information, attending meetings, and answering questions truthfully and completely. The policyholder’s cooperation is essential for the insurer to assess the claim and provide a defense.* Step 5: Preserve Documents and Evidence: Preserve all documents and evidence related to the claim.

This includes contracts, correspondence, project files, and any other relevant records. Do not alter or destroy any documents, as this could jeopardize coverage.* Step 6: Consult with Legal Counsel: Consider consulting with an attorney experienced in professional liability matters. Legal counsel can advise the policyholder on their rights and obligations under the policy and help navigate the claims process.* Step 7: Do Not Admit Liability: Do not admit liability or make any statements that could prejudice the insurer’s investigation or defense.

Any statements made to the claimant or third parties should be carefully considered and, if necessary, made in consultation with legal counsel.* Step 8: Follow the Insurer’s Instructions: Follow the instructions provided by the insurer regarding the defense of the claim. This may include working with the insurer’s chosen attorney, providing information, and participating in the legal proceedings.* Step 9: Stay Informed: Keep the insurer informed of any developments in the claim, such as new information, communications from the claimant, or changes in the legal proceedings.

Regular communication is vital.* Step 10: Review Settlement Offers: If the insurer proposes a settlement, carefully review the terms and conditions. Understand the implications of the settlement, including any impact on future premiums or policy terms.

Exploring the Role of Risk Management Practices in Reducing Liability Exposure is a Smart Move

Source: pxhere.com

Proactive risk management is a cornerstone of mitigating professional liability. Implementing robust practices significantly reduces the likelihood of claims arising from errors, omissions, or negligence. This approach is not merely about reacting to problems; it’s about anticipating potential issues and taking preventative measures to protect both the professional and the client. A well-defined risk management strategy fosters a culture of diligence, accountability, and continuous improvement, which are essential for long-term success and client trust.

The Impact of Risk Management on Liability Claim Minimization

Risk management practices are pivotal in minimizing professional liability claims. They involve a systematic approach to identifying, assessing, and controlling potential risks. This proactive methodology helps professionals to address potential problems before they escalate into claims. Key components of effective risk management include establishing standard operating procedures (SOPs), implementing clear client communication protocols, and promoting ongoing professional development. SOPs provide a framework for consistent and reliable service delivery.

Clear communication protocols ensure that clients are informed, expectations are managed, and misunderstandings are minimized. Ongoing professional development keeps professionals updated on industry best practices, legal requirements, and emerging risks. The combined effect is a significant reduction in errors, improved client satisfaction, and a decreased likelihood of liability claims.

Documenting Work for Defense Against Claims

Creating and maintaining detailed records of work is a critical aspect of defending against potential professional liability claims. Comprehensive documentation provides concrete evidence of the services provided, the decisions made, and the rationale behind those decisions. These records serve as a powerful defense, demonstrating that the professional acted with due diligence, followed established protocols, and met the standard of care expected within their profession.The types of records that should be kept vary depending on the profession, but generally include:

- Client Communications: Maintain a record of all communications with clients, including emails, letters, meeting minutes, and phone call summaries.

- Project Plans and Proposals: Document the scope of work, project timelines, deliverables, and any agreed-upon changes.

- Research and Analysis: Keep detailed records of any research, analysis, or assessments performed, including the sources used and the conclusions drawn.

- Decision-Making Processes: Document the rationale behind key decisions, including the alternatives considered and the factors that influenced the final choice.

- Progress Reports: Prepare regular progress reports to track the status of projects, highlight any challenges encountered, and document any actions taken to address them.

Organizing and storing these records securely is equally important. Implement a system that is easily searchable and accessible when needed. This could involve using electronic document management systems, cloud-based storage, or physical filing systems. Ensure that the storage system complies with relevant data privacy regulations and that access is restricted to authorized personnel. Regularly back up all records to prevent data loss.

A well-maintained and organized record-keeping system is a crucial element in defending against professional liability claims.

Key Risk Management Strategies for Reducing Liability

Implementing several risk management strategies can significantly reduce the risk of professional liability claims.Here are five key strategies:

- Develop and Adhere to Standard Operating Procedures (SOPs): Establish clear, documented procedures for all aspects of your work.

- Example: A financial advisor should have SOPs for client onboarding, investment recommendations, and account reviews. These procedures should be consistently followed to ensure that all clients receive the same level of service and that all relevant regulatory requirements are met.

- Implement Robust Client Communication Protocols: Maintain open, clear, and consistent communication with clients.

- Example: A lawyer should provide regular updates to clients on the status of their cases, explain legal strategies, and promptly respond to client inquiries.

- Prioritize Ongoing Professional Development: Stay current on industry best practices, legal requirements, and emerging risks through continuing education.

- Example: A doctor should participate in continuing medical education (CME) courses to stay updated on the latest medical advancements, treatment protocols, and ethical guidelines.

- Conduct Thorough Client Due Diligence: Assess the needs, expectations, and risk tolerance of each client.

- Example: An architect should conduct a thorough site analysis and consult with clients to understand their needs, budget, and design preferences before starting a project.

- Maintain Comprehensive Documentation: Keep detailed records of all work performed, including communications, decisions, and outcomes.

- Example: An engineer should document all design calculations, site inspections, and communication with contractors to provide evidence of due diligence and compliance with relevant standards.

Detailed FAQs

What is the difference between professional liability insurance and general liability insurance?

General liability insurance covers claims related to bodily injury or property damage caused by your business operations. Professional liability insurance, on the other hand, covers claims arising from your professional services, such as errors, omissions, or negligence.

Who needs professional liability insurance?

Professionals who provide advice, services, or designs to clients typically need professional liability insurance. This includes consultants, architects, engineers, lawyers, accountants, and many others.

How much does professional liability insurance cost?

The cost of professional liability insurance varies depending on several factors, including your profession, the scope of your services, your revenue, and your claims history. It’s best to get a quote from an insurance provider to determine your specific costs.

What happens if a claim is filed against me?

If a claim is filed, you should immediately notify your insurance provider. They will typically investigate the claim, provide legal defense, and pay any covered damages up to your policy limits.

Can I get professional liability insurance if I have had claims in the past?

Yes, but it might be more difficult or expensive. You may need to disclose your claims history and potentially pay higher premiums. Some insurers specialize in covering businesses with a history of claims.